Precious Metals Guide

A comprehensive and in-depth guide for investors looking to buy physical gold, silver, platinum, and palladium.

Table of contents

Precious Metals Guide

Buying gold, silver, platinum, or palladium for the first time can sometimes seem intimidating. But in reality, knowing a few basics is all it takes to start adding physical precious metals to your investment portfolio or collection with confidence.

BULLIONCRYPT offers to help you better understand and prepare your precious metal purchase.

An introduction to precious metals

Should you buy precious metals?

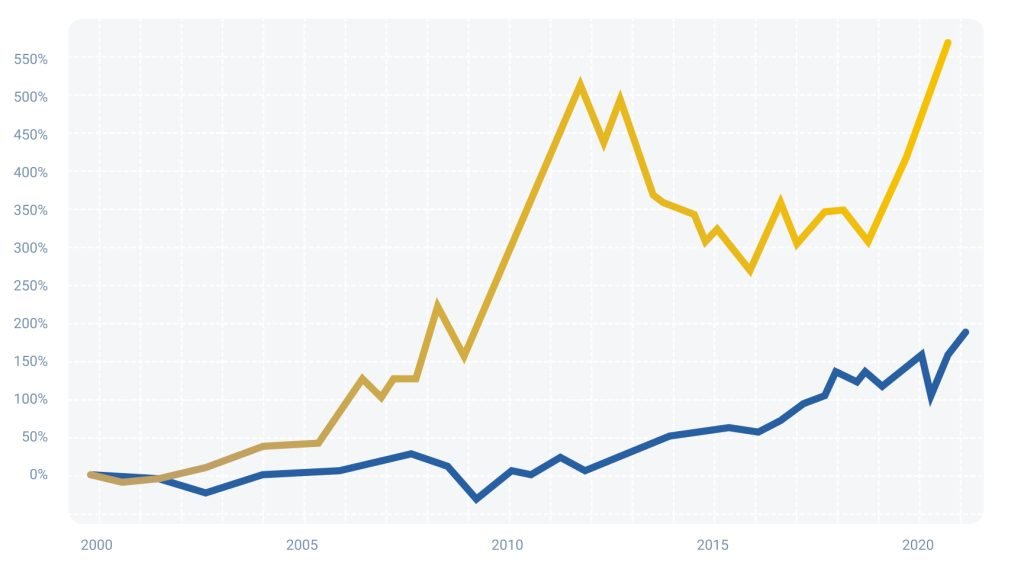

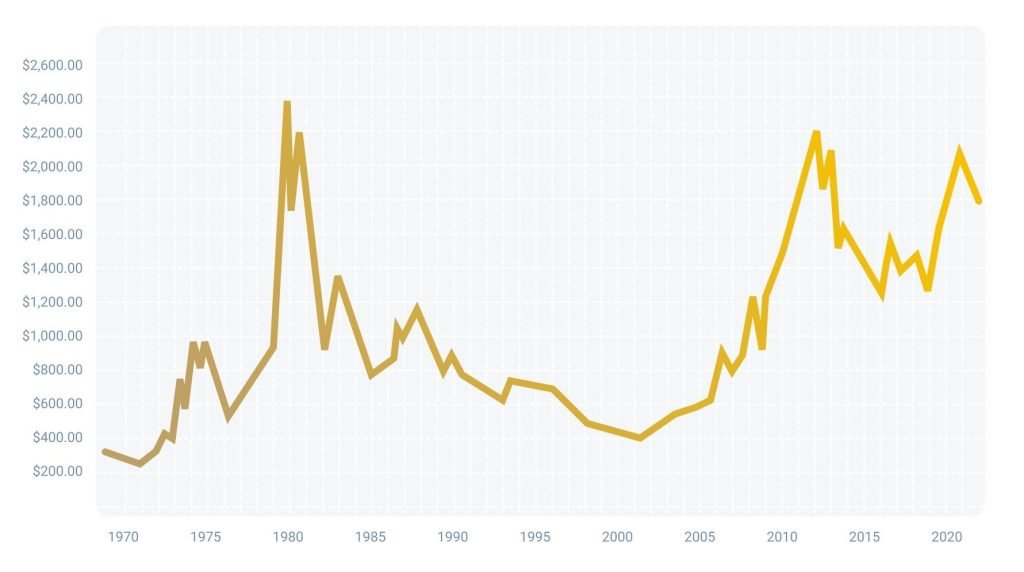

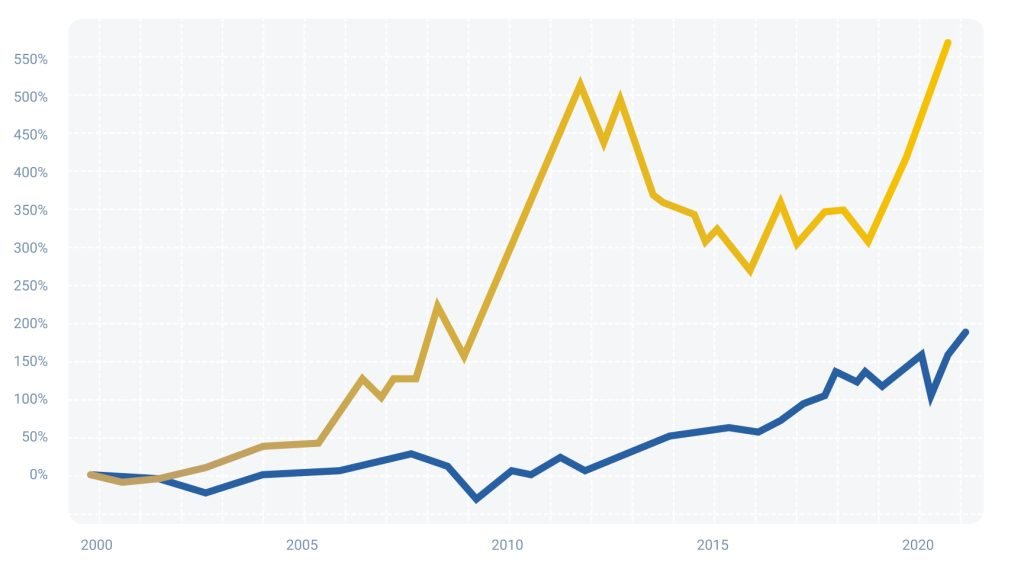

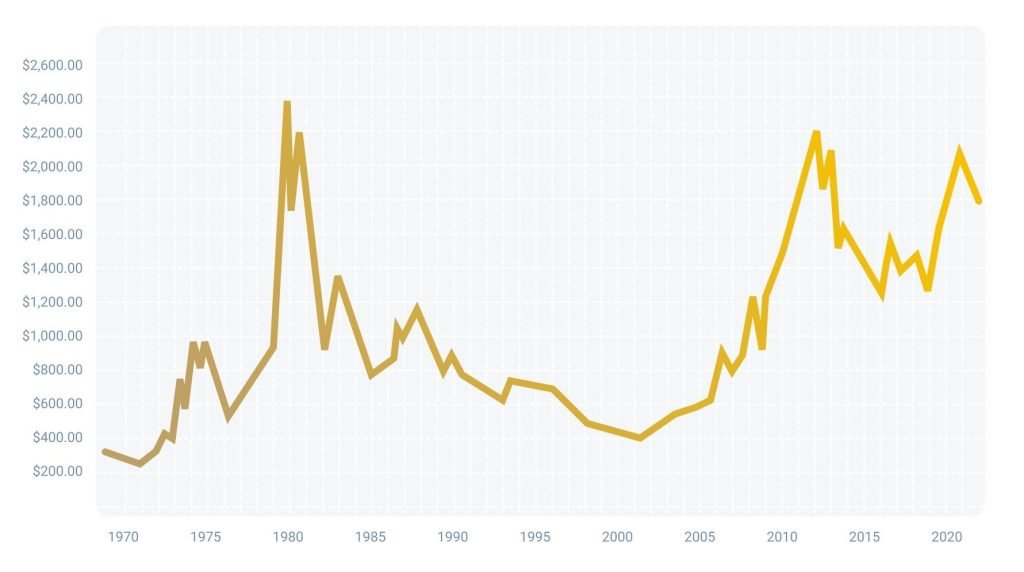

Are precious metals stable over the long term?

Their reputation as a "safe haven" and a "store of value" plays an important role in the stability appeal of precious metal prices. But gold, silver, platinum, and palladium are not only investment products or stores of value; they are also raw materials and consumer goods.

Indeed, beyond their commercial use in jewelry, there is a large and growing need for precious metals across many industries, from electronics and high technology to medicine, the automotive industry, and even space exploration. These commercial and industrial needs support the demand and supply of precious metals and therefore contribute to maintaining their price stability.

Thus, the purchase of precious metals tends to be a historically stable investment, due in particular to their numerous properties allowing for a variety of uses. Although their prices often move more slowly than other types of investments, they tend to increase over the medium and long term.

How does the price of precious metals work?

The prices of precious metals are the same throughout the world. They are most commonly expressed in U.S. dollars but can also be seen in other currencies (Euro, Swiss Franc, Pound Sterling, etc.). The price of physical precious metals is called spot price, this is the price as it appears on the market, its most common unit of measurement is the troy ounce, which is a historical unit of 31.1 grams of precious metals.

Precious metals have a global but centralized market, their true price is determined by the LBMA (London Bullion Market Association) and the LPPM (London Platinum and Palladium Market) in London.

How often are precious metals prices set?

- The LBMA gold price is determined twice a day on business days at 10:30 AM and 3:00 PM (London time) in US dollars.

- The LBMA silver price is determined once a day on business days at 12:00 PM (London time) in US dollars.

- The LBMA platinum and the LBMA palladium prices are fixed by the LPPM (London Platinum and Palladium Market) and the LME (London Metal Exchange), they are determined twice a day on business days at 9:45 AM and 2:00 PM (London time) in US dollars.

Breaking down the price of a precious metal product

Precious Metals Guide

A comprehensive and in-depth guide for investors looking to buy physical gold, silver, platinum, and palladium.

Table of contents

Precious Metals Guide

Buying gold, silver, platinum, or palladium for the first time can sometimes seem intimidating. But in reality, knowing a few basics is all it takes to start adding physical precious metals to your investment portfolio or collection with confidence.

BULLIONCRYPT offers to help you better understand and prepare your precious metal purchase.

An introduction to precious metals

Should you buy precious metals?

Are precious metals stable over the long term?

Their reputation as a "safe haven" and a "store of value" plays an important role in the stability appeal of precious metal prices. But gold, silver, platinum, and palladium are not only investment products or stores of value; they are also raw materials and consumer goods.

Indeed, beyond their commercial use in jewelry, there is a large and growing need for precious metals across many industries, from electronics and high technology to medicine, the automotive industry, and even space exploration. These commercial and industrial needs support the demand and supply of precious metals and therefore contribute to maintaining their price stability.

Thus, the purchase of precious metals tends to be a historically stable investment, due in particular to their numerous properties allowing for a variety of uses. Although their prices often move more slowly than other types of investments, they tend to increase over the medium and long term.

How does the price of precious metals work?

The prices of precious metals are the same throughout the world. They are most commonly expressed in U.S. dollars but can also be seen in other currencies (Euro, Swiss Franc, Pound Sterling, etc.). The price of physical precious metals is called spot price, this is the price as it appears on the market, its most common unit of measurement is the troy ounce, which is a historical unit of 31.1 grams of precious metals.

Precious metals have a global but centralized market, their true price is determined by the LBMA (London Bullion Market Association) and the LPPM (London Platinum and Palladium Market) in London.

How often are precious metals prices set?

- The LBMA gold price is determined twice a day on business days at 10:30 AM and 3:00 PM (London time) in US dollars.

- The LBMA silver price is determined once a day on business days at 12:00 PM (London time) in US dollars.

- The LBMA platinum and the LBMA palladium prices are fixed by the LPPM (London Platinum and Palladium Market) and the LME (London Metal Exchange), they are determined twice a day on business days at 9:45 AM and 2:00 PM (London time) in US dollars.